For those who are looking into information that can be useful if they understand it in detail, and loans to the common people of the Agricultural Cooperative Federation of Agricultural Cooperatives,

What you must know: For those who are looking for loans for the common people of the Agricultural Cooperative Federation of Agricultural Cooperatives,

In the case of differences between the first financial sector, which refers to banks, insurance companies, savings banks, etc., it usually comes from interest rates, but just because interest rates are low, it cannot be judged that they are unconditionally profitable. Although it may be difficult to receive a lot of money because it is limited to 70% of income, the maximum limit of the second financial sector is about 15.09%, but the maximum limit is about twice that of the first financial sector. Furthermore, since your credit rating may determine whether or not to examine the loan, you should be able to use the loan products in priority order to solve the problem of funds in front of you by choosing between interest rates and maximum limits.

Latest information on loans for non-stop loan products agricultural cooperatives to the common people

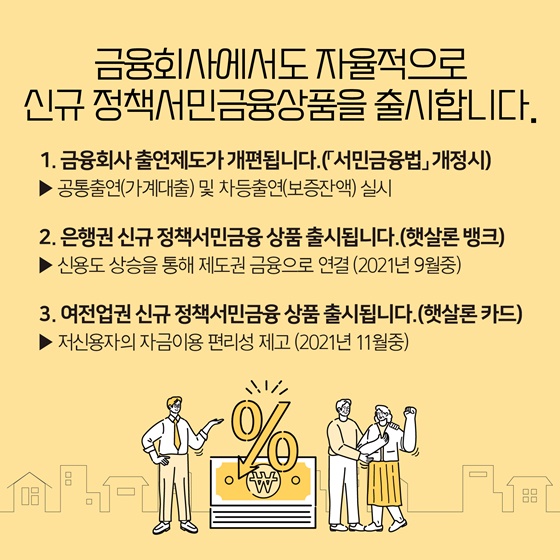

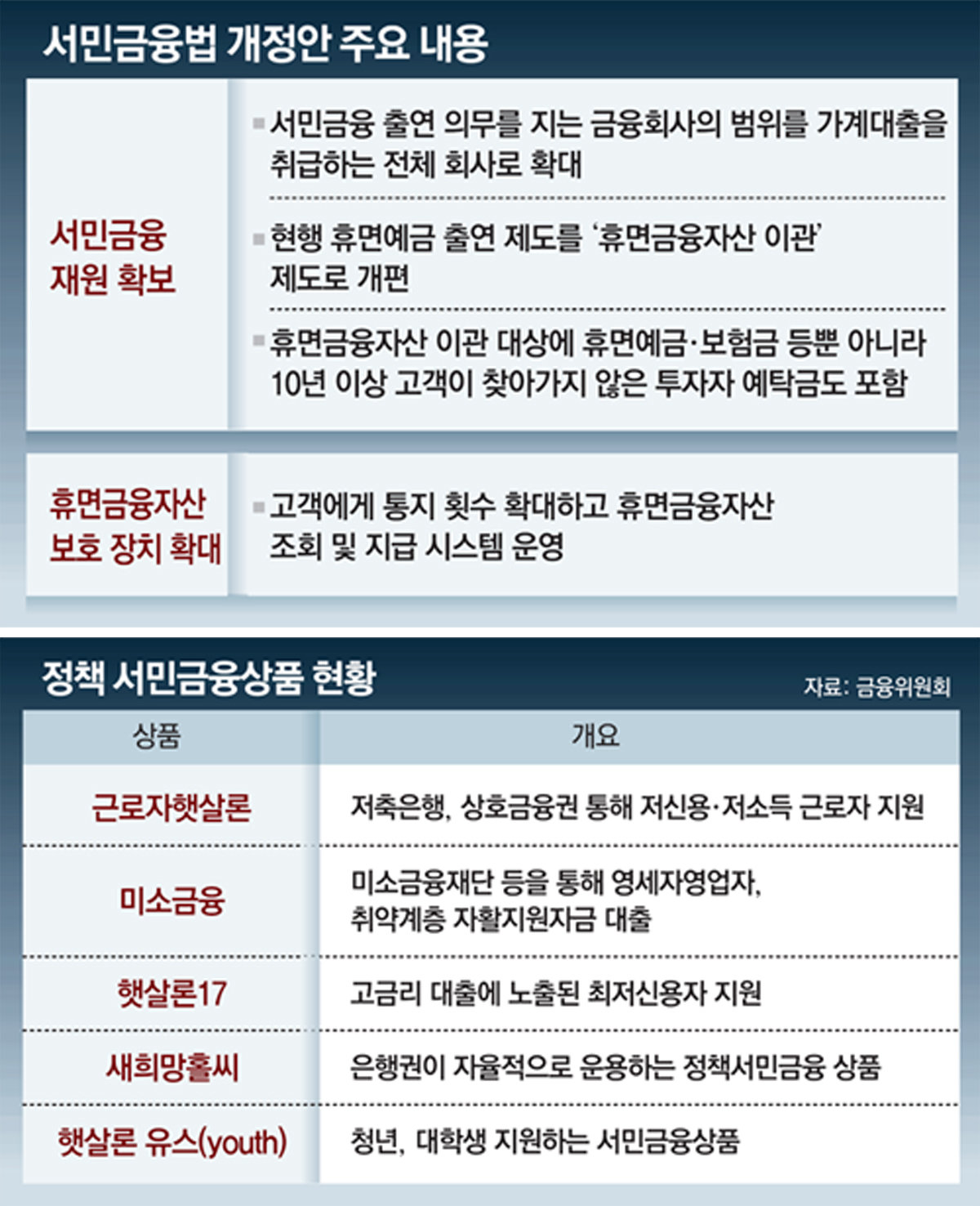

There are policy products for those who have difficulty in financing or have poor repayment ability due to poor cash, but they often give approval at low rates for those who have low creditworthiness such as Hessalrone or Hessalrone. Such products can be repaid within three to six years at a low interest rate of 8.80 percent or less, and can be used effectively without a good credit rating, and many people use them when financial conditions are not good.

For those of you who are interested in loans to the common people of the National Agricultural Cooperative Federation, which can increase the rate of return,

We will also introduce you to the investment and financial technology know-how that has recently become popular among the younger generation due to the diversification of income types other than general income. First of all, for those who recognize that real estate investment has to raise a large amount of their holdings, we will start with a mortgage. In addition to the user’s credit, the maximum limit of mortgage loans is determined by the target house’s valuation rate, LTV, and DTI, so even if the credit rating is not good, anyone can easily use it with a little cash.In other words, if you know the knowledge that is not easy, you can enter the housing investment with 9 million won. In addition, if you go through a savings bank derived from a securities company, you can get approval quickly at an interest rate of 3.56% as a stock guarantee, so I think this method is useful if you know it.

If you study in detail, you can use it when you need a large amount of money.I’ll tell you about loans for the common people of agricultural cooperatives!

Whether borrowing for the purpose of living expenses or financing necessary for investment or financial management, in order to advance from an advantageous position in society these days, we must keep an eye on the tendency of the economy to come and go. However, as unknown information and urgent decisions directly lead to economic disadvantages, we must enter carefully and make useful use of them. You can earn and repay money through financial technology without spending your own money, and if you understand the loan information, you can jump into real estate in overheated speculation areas without your money. Just as there is an indelible difference between using the same loan at 3% interest rate and repaying it at 12.50%, the key point is to minimize risk according to your conditions and use good products in the right place.

Previous Image Next Image

Previous Image Next Image

Previous Image Next Image